New York’s JFK Airport is one of the most iconic international gateways in the world. It’s where millions of people begin and end their journeys every year—business trips, family visits, long-haul adventures, and quick weekend getaways.

With over 70 airlines operating across six terminals, JFK is a critical hub in global aviation.

But behind the scenes, there’s a competitive dance happening daily on the tarmac: a strategic battle between three U.S. airlines, each trying to secure their place at the top.

Delta Air Lines, JetBlue Airways, and American Airlines are the major players. They each have different strengths, goals, and roles at JFK—but only one can truly be considered “the king of New York.”

Let’s take a closer look at each airline’s presence at JFK, how they operate, and what the numbers—and travelers—are saying.

A Quick Look at the Numbers

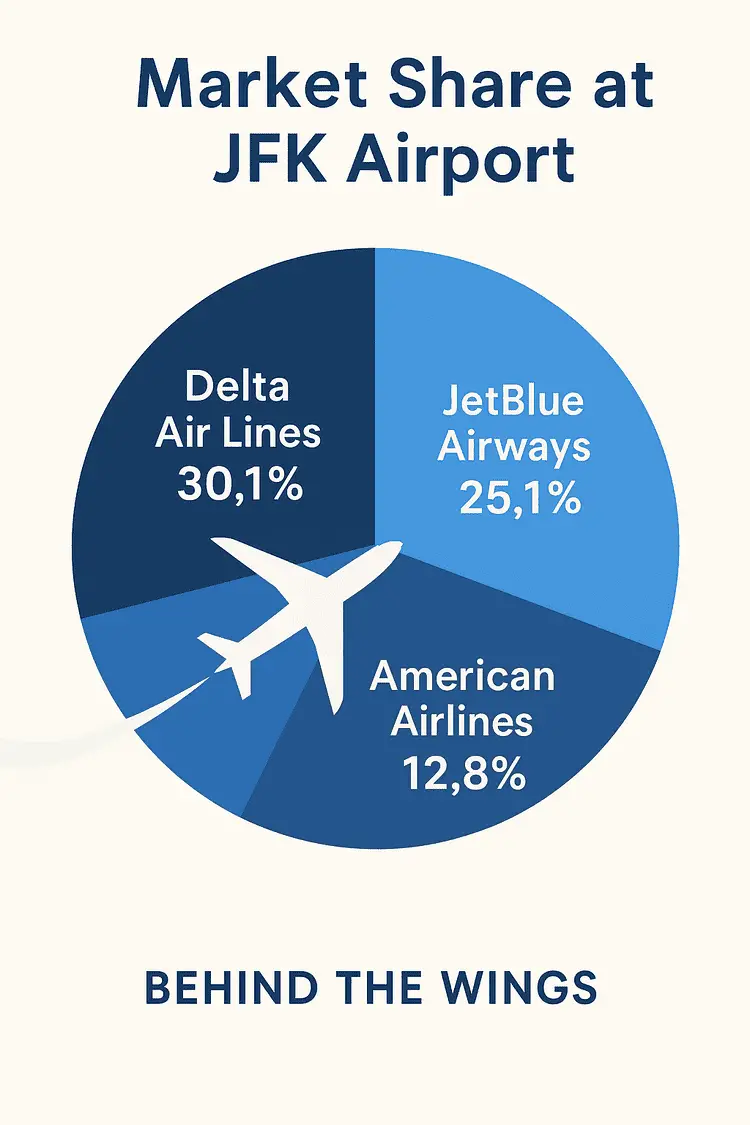

According to data from early 2024, here’s how the market share breaks down at JFK:

- Delta Air Lines: ~30.1%

- JetBlue Airways: ~25.1%

- American Airlines: ~12.8%

Delta clearly holds the largest portion of traffic at the airport.

But market share is only part of the story. Each airline uses JFK differently—and how they operate reveals a lot about who’s really leading the way.

Delta Air Lines: The Power Player

Delta is arguably the most established airline at JFK.

It uses the airport as one of its primary international hubs, especially for transatlantic flights. Its main base is Terminal 4, a spacious and modern terminal that houses both international and domestic operations. Delta also had partial use of Terminal 2 before it was closed and merged into T4 operations to streamline connections.

Delta’s route map from JFK includes cities all over Europe (like Amsterdam, Paris, and Rome), as well as destinations in Africa, the Middle East, and Latin America.

Domestically, Delta uses JFK to connect travelers to key business and leisure markets across the U.S. It’s also strong in Caribbean routes, which are popular year-round.

Business travelers often choose Delta for its frequent service, upgraded cabins (like Delta One and Comfort+), and loyalty program.

For flight attendants and crew, Delta’s operations at JFK are large and well-coordinated, with room for growth and scheduling flexibility.

JetBlue Airways: The Hometown Challenger

JetBlue might not have the largest share at JFK, but it plays a unique and important role. Headquartered in New York, JetBlue operates primarily from Terminal 5—a terminal designed around their brand and known for its clean design and efficient layout.

JetBlue built its reputation on offering affordable fares without compromising on comfort. Their seats are spacious, the inflight entertainment is excellent, and the snacks aren’t bad either.

But in recent years, JetBlue has shifted toward more premium offerings—especially on transatlantic flights.

That’s right: JetBlue is now flying to London, Paris, Dublin, and Amsterdam from JFK, with plans to expand. Their Mint class—essentially a lie-flat business product—is surprisingly luxurious for a low-cost carrier.

Despite some recent cuts to underperforming domestic routes (such as JFK to Austin and Miami), JetBlue’s focus remains on building strength in international leisure and premium segments.

So, while it may not have Delta’s size or global network, JetBlue has carved out a competitive—and very New York—niche.

American Airlines: The Legacy Competitor

American Airlines operates out of Terminal 8, which it shares with partners in the oneworld alliance. JFK is an important airport for American, but it’s not a fortress hub like Dallas/Fort Worth or Charlotte.

That makes a difference.

At JFK, American focuses on long-haul international flights, particularly to London, Madrid, Tokyo, and several cities in South America.

It also connects JFK with major domestic markets like Los Angeles, Miami, and Phoenix.

However, American has been gradually reducing its presence at JFK over the years.

Some of its former routes have disappeared, and it doesn’t offer the same breadth of connectivity as Delta or even JetBlue.

That said, American plays an important role in global alliances.

Through oneworld partners like British Airways and Iberia, travelers can connect to dozens of additional cities with a single ticket and shared frequent flyer benefits.

For international flyers loyal to oneworld, that’s a big plus.

How Each Airline Positions Itself at JFK

Each airline isn’t just competing for passengers—they’re also crafting a unique identity at JFK, shaped by their business models and target demographics.

Delta Air Lines positions itself as the premium, business-focused carrier.

With JFK as a major international hub, Delta connects corporate travelers across continents through a refined travel experience.

Its large presence, upgraded terminals, and loyalty perks are designed to keep frequent flyers loyal.

JetBlue Airways leans into its role as New York’s hometown favorite, known for a relaxed vibe, comfort-focused economy seats, and affordable transatlantic options.

Its growing international network and signature Mint product show that JetBlue is reaching for a higher-end market without losing its value-driven DNA.

American Airlines, while still active at JFK, takes a network-support role. It focuses on long-haul routes and alliance connectivity, particularly through its oneworld partners.

Rather than dominating locally, American leverages JFK to feed its global strategy, offering options for international travelers loyal to its ecosystem.

This strategic positioning affects not only what routes are flown, but also how crews are assigned, how lounges are prioritized, and how each airline invests in its future at JFK.

So, Who Really Rules JFK?

It depends on how you look at it.

If we’re talking raw market share, Delta is on top. It operates more flights, serves more destinations, and invests heavily in infrastructure at JFK. For business travelers, Delta is often the go-to.

JetBlue, though, is not far behind—and they bring a different kind of energy. As a New York-based carrier, JetBlue is beloved by many locals. Their customer service, transatlantic push, and innovative offerings make them a serious contender for JFK loyalty.

American Airlines, while still significant, seems to be stepping back from JFK as a central focus. Its presence remains strong on key long-haul routes and through alliance connectivity, but it’s not competing for dominance in the same way as Delta and JetBlue.

My Take

Personally, I think Delta deserves the top spot—for now. Their investment in JFK is strategic and long-term. Their international and domestic balance makes them extremely useful for all types of travelers, and their consistency in service is hard to beat.

But I also think JetBlue is playing the long game very well.

Their move into transatlantic flying shows they’re not afraid to take risks.

Their Mint product is fantastic, and their reputation for comfort and good value still holds.

If they continue improving their route network and avoid overextending, they could challenge Delta in the next few years.

As for American Airlines, I believe they’ve accepted a more focused role at JFK. That’s not a bad thing—but it’s a different strategy.

It may appeal more to loyal AAdvantage members or travelers booking through oneworld connections, rather than those seeking frequent local flights.

The Future of JFK’s Airline Landscape

JFK is always evolving—and so is the competition among its top carriers.

Delta appears to have the most stable grip on its JFK presence. Continued investment in terminals, lounges, and route expansion shows it’s planning for long-term dominance. But there’s only so much space at JFK, and saturation could limit future growth unless Delta forges new alliances or shifts strategy.

JetBlue, while still growing, may face challenges as it stretches internationally. With a smaller fleet and tighter margins than legacy carriers, maintaining both domestic relevance and transatlantic presence will take precise execution. However, its creative approach to cabin design and customer loyalty could help it punch above its weight.

American Airlines might continue its gradual retreat—or surprise everyone with a resurgence. Much depends on the success of Terminal 8 partnerships and whether American shifts more focus back to New York. As the airline industry faces further consolidation and shifting demand patterns, American’s next move at JFK will be key to watch.

And beyond these three, don’t count out international carriers or ultra-low-cost entrants, especially as JFK’s infrastructure modernizes. The battle for New York is far from over—and it’s only getting more interesting.